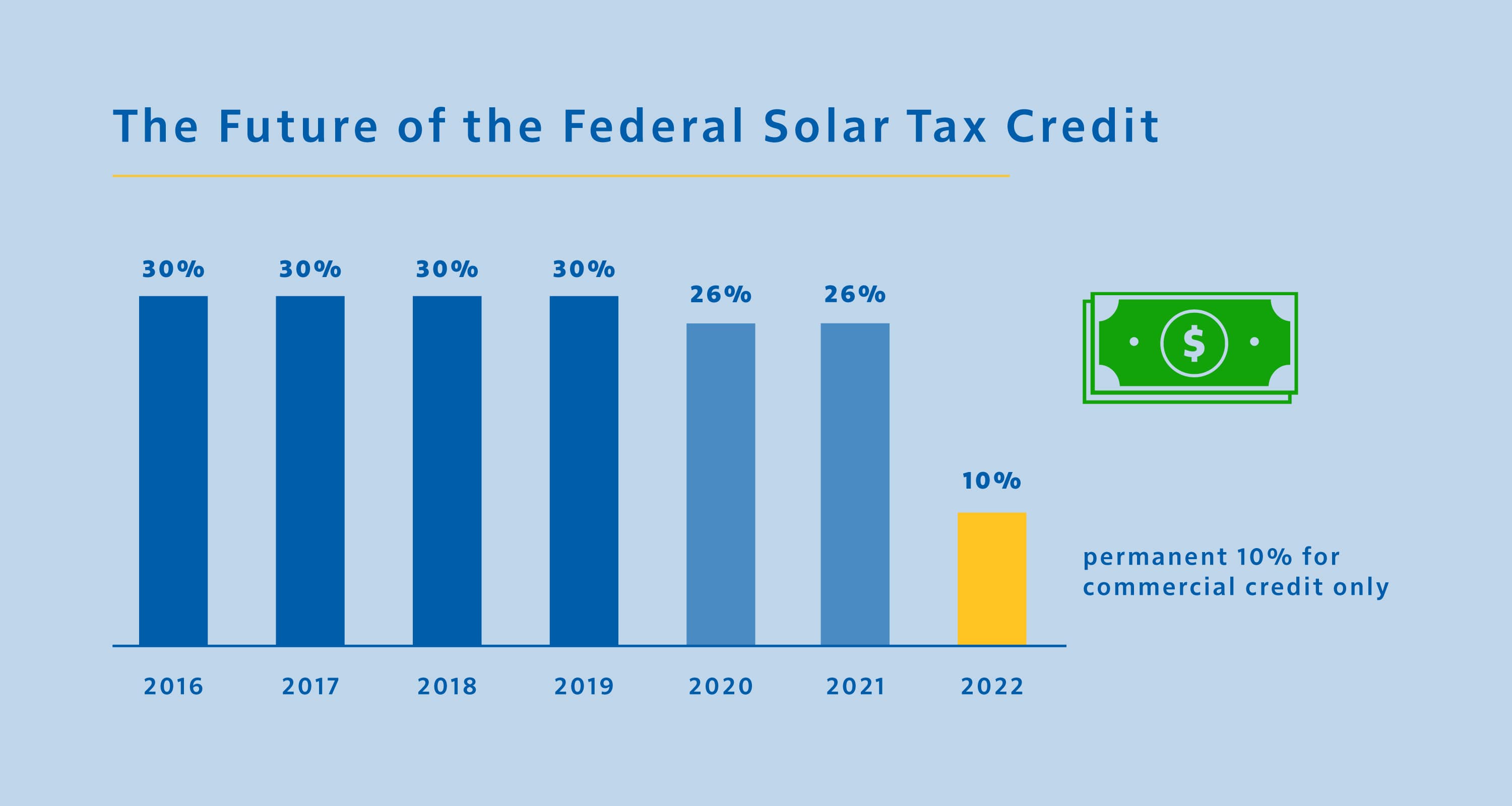

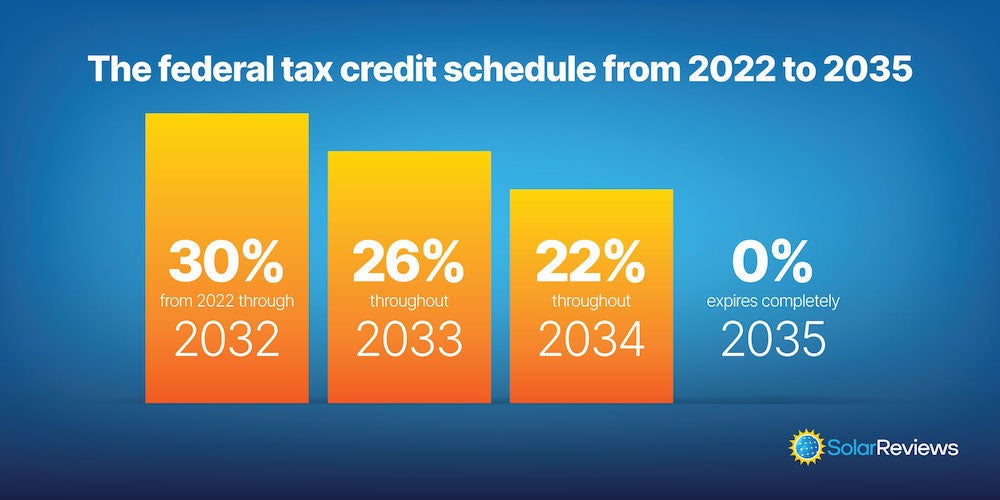

2025 Tax Credits For Solar Bouwmarkt. The investment tax credit (itc) or solar federal tax credit is a nationwide incentive for homeowners and business owners who purchase solar panels directly with cash or using a loan. The 2025 federal solar tax credit allows you to deduct a percentage of your solar installation.

Quantifying available solar tax credits requires tallying system expenditures on the solar asset. How to claim your solar tax credit in 2025.

2025 Tax Credits For Solar Energy Ranee Casandra, In 2025, the federal solar tax credit is equal to 30% of solar installation costs and it directly.

Solar Tax Credits For 2025 Marlo Shantee, The ira extended the itc under irc section 48 for most projects that begin.

Solar Energy Tax Credits 2025 Roze Brandea, This incentive is also known as the investment tax credit (itc) and residential clean energy.

Tax Credits 2025 List Marga Eugenia, Installing solar panels in 2025 qualifies you for a 30% tax credit on installation.

2025 Tax Credits For Solar Projects Vera Allison, In 2025, several tax credits and incentives are available to help offset the costs associated with.

2025 Tax Credits For Solar Projects Vera Allison, Certain states offer additional tax credits for solar system purchases.

Solar Tax Credits 2025 Averil Brittney, In 2025, several tax credits and incentives are available to help offset the costs associated with.

What Is The Tax Credit For Solar Panels In 2025 Cary Marthe, The federal solar tax credit can make improving your energy grid investment a lot more.